Zipline Beginner Tutorial¶

Basics¶

Zipline is an open-source algorithmic trading simulator written in Python.

The source can be found at: https://github.com/quantopian/zipline

Some benefits include:

Realistic: slippage, transaction costs, order delays.

Stream-based: Process each event individually, avoids look-ahead bias.

Batteries included: Common transforms (moving average) as well as common risk calculations (Sharpe).

Developed and continuously updated by Quantopian which provides an easy-to-use web-interface to Zipline, 10 years of minute-resolution historical US stock data, and live-trading capabilities. This tutorial is directed at users wishing to use Zipline without using Quantopian. If you instead want to get started on Quantopian, see here.

This tutorial assumes that you have zipline correctly installed, see the installation instructions if you haven’t set up zipline yet.

Every zipline algorithm consists of two functions you have to

define:

initialize(context)handle_data(context, data)

Before the start of the algorithm, zipline calls the

initialize() function and passes in a context variable.

context is a persistent namespace for you to store variables you

need to access from one algorithm iteration to the next.

After the algorithm has been initialized, zipline calls the

handle_data() function once for each event. At every call, it passes

the same context variable and an event-frame called data

containing the current trading bar with open, high, low, and close

(OHLC) prices as well as volume for each stock in your universe. For

more information on these functions, see the relevant part of the

Quantopian docs.

My First Algorithm¶

Let’s take a look at a very simple algorithm from the examples

directory, buyapple.py:

from zipline.examples import buyapple

buyapple??

from zipline.api import order, record, symbol

def initialize(context):

pass

def handle_data(context, data):

order(symbol('AAPL'), 10)

record(AAPL=data.current(symbol('AAPL'), 'price'))

As you can see, we first have to import some functions we would like to

use. All functions commonly used in your algorithm can be found in

zipline.api. Here we are using order() which takes two

arguments: a security object, and a number specifying how many stocks you would

like to order (if negative, order() will sell/short

stocks). In this case we want to order 10 shares of Apple at each iteration. For

more documentation on order(), see the Quantopian docs.

Finally, the record() function allows you to save the value

of a variable at each iteration. You provide it with a name for the variable

together with the variable itself: varname=var. After the algorithm

finished running you will have access to each variable value you tracked

with record() under the name you provided (we will see this

further below). You also see how we can access the current price data of the

AAPL stock in the data event frame (for more information see

here).

Running the Algorithm¶

To now test this algorithm on financial data, zipline provides three

interfaces: A command-line interface, IPython Notebook magic, and

run_algorithm().

Ingesting Data¶

If you haven’t ingested the data, then run:

$ zipline ingest [-b <bundle>]

where <bundle> is the name of the bundle to ingest, defaulting to

quantopian-quandl.

you can check out the ingesting data section for more detail.

Command Line Interface¶

After you installed zipline you should be able to execute the following

from your command line (e.g. cmd.exe on Windows, or the Terminal app

on OSX):

$ zipline run --help

Usage: zipline run [OPTIONS]

Run a backtest for the given algorithm.

Options:

-f, --algofile FILENAME The file that contains the algorithm to run.

-t, --algotext TEXT The algorithm script to run.

-D, --define TEXT Define a name to be bound in the namespace

before executing the algotext. For example

'-Dname=value'. The value may be any python

expression. These are evaluated in order so

they may refer to previously defined names.

--data-frequency [daily|minute]

The data frequency of the simulation.

[default: daily]

--capital-base FLOAT The starting capital for the simulation.

[default: 10000000.0]

-b, --bundle BUNDLE-NAME The data bundle to use for the simulation.

[default: quandl]

--bundle-timestamp TIMESTAMP The date to lookup data on or before.

[default: <current-time>]

-s, --start DATE The start date of the simulation.

-e, --end DATE The end date of the simulation.

-o, --output FILENAME The location to write the perf data. If this

is '-' the perf will be written to stdout.

[default: -]

--trading-calendar TRADING-CALENDAR

The calendar you want to use e.g. LSE. NYSE

is the default.

--print-algo / --no-print-algo Print the algorithm to stdout.

--benchmark-file The csv file that contains the benchmark

returns (date, returns columns)

--benchmark-symbol The instrument's symbol to be used as

a benchmark.

(should exist in the ingested bundle)

--benchmark-sid The sid of the instrument to be used as a

benchmark.

(should exist in the ingested bundle)

--no-benchmark This flag is used to set the benchmark to

zero. Alpha, beta and benchmark metrics

are not calculated

--help Show this message and exit.

As you can see there are a couple of flags that specify where to find your

algorithm (-f) as well as parameters specifying which data to use,

defaulting to quandl. There are also arguments for

the date range to run the algorithm over (--start and --end).To use a

benchmark, you need to choose one of the benchmark options listed before. You can

always use the option (--no-benchmark) that uses zero returns as a benchmark (

alpha, beta and benchmark metrics are not calculated in this case).

Finally, you’ll want to save the performance metrics of your algorithm so that you can

analyze how it performed. This is done via the --output flag and will cause

it to write the performance DataFrame in the pickle Python file format.

Note that you can also define a configuration file with these parameters that

you can then conveniently pass to the -c option so that you don’t have to

supply the command line args all the time (see the .conf files in the examples

directory).

Thus, to execute our algorithm from above and save the results to

buyapple_out.pickle, we call zipline run as follows:

zipline run -f ../zipline/examples/buyapple.py --start 2016-1-1 --end 2018-1-1 -o buyapple_out.pickle --no-benchmark

AAPL

[2018-01-03 04:30:51.843465] INFO: Performance: Simulated 503 trading days out of 503.

[2018-01-03 04:30:51.843598] INFO: Performance: first open: 2016-01-04 14:31:00+00:00

[2018-01-03 04:30:51.843672] INFO: Performance: last close: 2017-12-29 21:00:00+00:00

run first calls the initialize() function, and then

streams the historical stock price day-by-day through handle_data().

After each call to handle_data() we instruct zipline to order 10

stocks of AAPL. After the call of the order() function, zipline

enters the ordered stock and amount in the order book. After the

handle_data() function has finished, zipline looks for any open

orders and tries to fill them. If the trading volume is high enough for

this stock, the order is executed after adding the commission and

applying the slippage model which models the influence of your order on

the stock price, so your algorithm will be charged more than just the

stock price * 10. (Note, that you can also change the commission and

slippage model that zipline uses, see the Quantopian

docs for more

information).

Let’s take a quick look at the performance DataFrame. For this, we

use pandas from inside the IPython Notebook and print the first ten

rows. Note that zipline makes heavy usage of pandas, especially

for data input and outputting so it’s worth spending some time to learn

it.

import pandas as pd

perf = pd.read_pickle('buyapple_out.pickle') # read in perf DataFrame

perf.head()

| AAPL | algo_volatility | algorithm_period_return | alpha | benchmark_period_return | benchmark_volatility | beta | capital_used | ending_cash | ending_exposure | ending_value | excess_return | gross_leverage | long_exposure | long_value | longs_count | max_drawdown | max_leverage | net_leverage | orders | period_close | period_label | period_open | pnl | portfolio_value | positions | returns | sharpe | short_exposure | short_value | shorts_count | sortino | starting_cash | starting_exposure | starting_value | trading_days | transactions | treasury_period_return | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2016-01-04 21:00:00+00:00 | 105.35 | NaN | 0.000000e+00 | NaN | -0.013983 | NaN | NaN | 0.0 | 10000000.0 | 0.0 | 0.0 | 0.0 | 0.000000 | 0.0 | 0.0 | 0 | 0.000000e+00 | 0.0 | 0.000000 | [{\'dt\': 2016-01-04 21:00:00+00:00, \'reason\': N... | 2016-01-04 21:00:00+00:00 | 2016-01 | 2016-01-04 14:31:00+00:00 | 0.0 | 10000000.0 | [] | 0.000000e+00 | NaN | 0 | 0 | 0 | NaN | 10000000.0 | 0.0 | 0.0 | 1 | [] | 0.0 |

| 2016-01-05 21:00:00+00:00 | 102.71 | 0.000001 | -1.000000e-07 | -0.000022 | -0.012312 | 0.175994 | -0.000006 | -1028.1 | 9998971.9 | 1027.1 | 1027.1 | 0.0 | 0.000103 | 1027.1 | 1027.1 | 1 | -1.000000e-07 | 0.0 | 0.000103 | [{\'dt\': 2016-01-05 21:00:00+00:00, \'reason\': N... | 2016-01-05 21:00:00+00:00 | 2016-01 | 2016-01-05 14:31:00+00:00 | -1.0 | 9999999.0 | [{\'sid\': Equity(8 [AAPL]), \'last_sale_price\': ... | -1.000000e-07 | -11.224972 | 0 | 0 | 0 | -11.224972 | 10000000.0 | 0.0 | 0.0 | 2 | [{\'order_id\': \'4011063b5c094e82a5391527044098b... | 0.0 |

| 2016-01-06 21:00:00+00:00 | 100.70 | 0.000019 | -2.210000e-06 | -0.000073 | -0.024771 | 0.137853 | 0.000054 | -1008.0 | 9997963.9 | 2014.0 | 2014.0 | 0.0 | 0.000201 | 2014.0 | 2014.0 | 1 | -2.210000e-06 | 0.0 | 0.000201 | [{\'dt\': 2016-01-06 21:00:00+00:00, \'reason\': N... | 2016-01-06 21:00:00+00:00 | 2016-01 | 2016-01-06 14:31:00+00:00 | -21.1 | 9999977.9 | [{\'sid\': Equity(8 [AAPL]), \'last_sale_price\': ... | -2.110000e-06 | -9.823839 | 0 | 0 | 0 | -9.588756 | 9998971.9 | 1027.1 | 1027.1 | 3 | [{\'order_id\': \'3bf9fe20cc46468d99f741474226c03... | 0.0 |

| 2016-01-07 21:00:00+00:00 | 96.45 | 0.000064 | -1.081000e-05 | 0.000243 | -0.048168 | 0.167868 | 0.000300 | -965.5 | 9996998.4 | 2893.5 | 2893.5 | 0.0 | 0.000289 | 2893.5 | 2893.5 | 1 | -1.081000e-05 | 0.0 | 0.000289 | [{\'dt\': 2016-01-07 21:00:00+00:00, \'reason\': N... | 2016-01-07 21:00:00+00:00 | 2016-01 | 2016-01-07 14:31:00+00:00 | -86.0 | 9999891.9 | [{\'sid\': Equity(8 [AAPL]), \'last_sale_price\': ... | -8.600019e-06 | -10.592737 | 0 | 0 | 0 | -9.688947 | 9997963.9 | 2014.0 | 2014.0 | 4 | [{\'order_id\': \'6af6aed9fbb44a6bba17e802051b94d... | 0.0 |

| 2016-01-08 21:00:00+00:00 | 96.96 | 0.000063 | -9.380000e-06 | 0.000466 | -0.058601 | 0.145654 | 0.000311 | -970.6 | 9996027.8 | 3878.4 | 3878.4 | 0.0 | 0.000388 | 3878.4 | 3878.4 | 1 | -1.081000e-05 | 0.0 | 0.000388 | [{\'dt\': 2016-01-08 21:00:00+00:00, \'reason\': N... | 2016-01-08 21:00:00+00:00 | 2016-01 | 2016-01-08 14:31:00+00:00 | 14.3 | 9999906.2 | [{\'sid\': Equity(8 [AAPL]), \'last_sale_price\': ... | 1.430015e-06 | -7.511729 | 0 | 0 | 0 | -7.519659 | 9996998.4 | 2893.5 | 2893.5 | 5 | [{\'order_id\': \'18f64975732449a18fca06e9c69bf5c... | 0.0 |

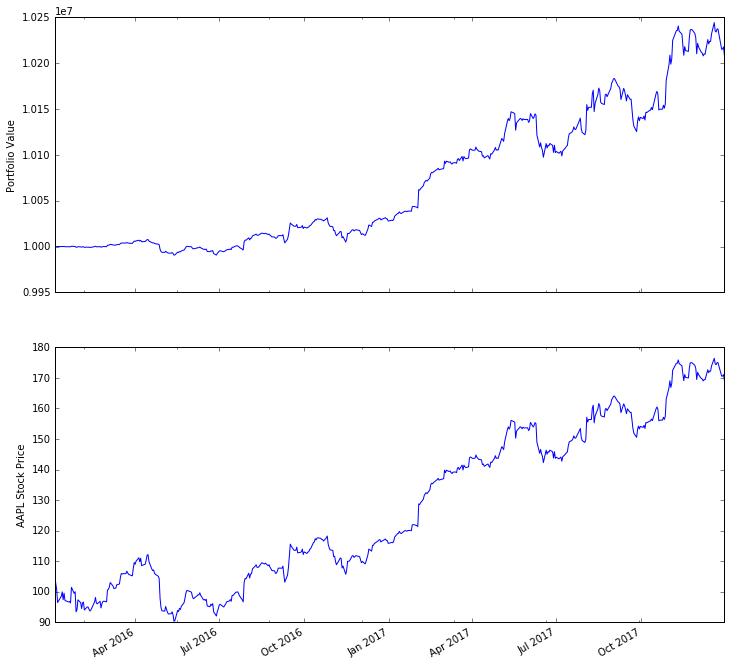

As you can see, there is a row for each trading day, starting on the

first business day of 2016. In the columns you can find various

information about the state of your algorithm. The very first column

AAPL was placed there by the record() function mentioned earlier

and allows us to plot the price of apple. For example, we could easily

examine now how our portfolio value changed over time compared to the

AAPL stock price.

%pylab inline

figsize(12, 12)

import matplotlib.pyplot as plt

ax1 = plt.subplot(211)

perf.portfolio_value.plot(ax=ax1)

ax1.set_ylabel('Portfolio Value')

ax2 = plt.subplot(212, sharex=ax1)

perf.AAPL.plot(ax=ax2)

ax2.set_ylabel('AAPL Stock Price')

Populating the interactive namespace from numpy and matplotlib

<matplotlib.text.Text at 0x10c48c198>

As you can see, our algorithm performance as assessed by the

portfolio_value closely matches that of the AAPL stock price. This

is not surprising as our algorithm only bought AAPL every chance it got.

IPython Notebook¶

The IPython Notebook is a very

powerful browser-based interface to a Python interpreter (this tutorial

was written in it). As it is already the de-facto interface for most

quantitative researchers zipline provides an easy way to run your

algorithm inside the Notebook without requiring you to use the CLI.

To use it you have to write your algorithm in a cell and let zipline

know that it is supposed to run this algorithm. This is done via the

%%zipline IPython magic command that is available after you

import zipline from within the IPython Notebook. This magic takes

the same arguments as the command line interface described above. Thus

to run the algorithm from above with the same parameters we just have to

execute the following cell after importing zipline to register the

magic.

%load_ext zipline

%%zipline --start 2016-1-1 --end 2018-1-1

from zipline.api import symbol, order, record

def initialize(context):

pass

def handle_data(context, data):

order(symbol('AAPL'), 10)

record(AAPL=data[symbol('AAPL')].price)

Note that we did not have to specify an input file as above since the

magic will use the contents of the cell and look for your algorithm

functions there. Also, instead of defining an output file we are

specifying a variable name with -o that will be created in the name

space and contain the performance DataFrame we looked at above.

_.head()

| AAPL | algo_volatility | algorithm_period_return | alpha | benchmark_period_return | benchmark_volatility | beta | capital_used | ending_cash | ending_exposure | ending_value | excess_return | gross_leverage | long_exposure | long_value | longs_count | max_drawdown | max_leverage | net_leverage | orders | period_close | period_label | period_open | pnl | portfolio_value | positions | returns | sharpe | short_exposure | short_value | shorts_count | sortino | starting_cash | starting_exposure | starting_value | trading_days | transactions | treasury_period_return | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2016-01-04 21:00:00+00:00 | 105.35 | NaN | 0.000000e+00 | NaN | -0.013983 | NaN | NaN | 0.00 | 10000000.00 | 0.0 | 0.0 | 0.0 | 0.000000 | 0.0 | 0.0 | 0 | 0.000000e+00 | 0.0 | 0.000000 | [{\'created\': 2016-01-04 21:00:00+00:00, \'reaso... | 2016-01-04 21:00:00+00:00 | 2016-01 | 2016-01-04 14:31:00+00:00 | 0.00 | 10000000.00 | [] | 0.000000e+00 | NaN | 0 | 0 | 0 | NaN | 10000000.00 | 0.0 | 0.0 | 1 | [] | 0.0 |

| 2016-01-05 21:00:00+00:00 | 102.71 | 1.122497e-08 | -1.000000e-09 | -2.247510e-07 | -0.012312 | 0.175994 | -6.378047e-08 | -1027.11 | 9998972.89 | 1027.1 | 1027.1 | 0.0 | 0.000103 | 1027.1 | 1027.1 | 1 | -9.999999e-10 | 0.0 | 0.000103 | [{\'created\': 2016-01-04 21:00:00+00:00, \'reaso... | 2016-01-05 21:00:00+00:00 | 2016-01 | 2016-01-05 14:31:00+00:00 | -0.01 | 9999999.99 | [{\'amount\': 10, \'cost_basis\': 102.711000000000... | -1.000000e-09 | -11.224972 | 0 | 0 | 0 | -11.224972 | 10000000.00 | 0.0 | 0.0 | 2 | [{\'dt\': 2016-01-05 21:00:00+00:00, \'order_id\':... | 0.0 |

| 2016-01-06 21:00:00+00:00 | 100.70 | 1.842654e-05 | -2.012000e-06 | -4.883861e-05 | -0.024771 | 0.137853 | 5.744807e-05 | -1007.01 | 9997965.88 | 2014.0 | 2014.0 | 0.0 | 0.000201 | 2014.0 | 2014.0 | 1 | -2.012000e-06 | 0.0 | 0.000201 | [{\'created\': 2016-01-05 21:00:00+00:00, \'reaso... | 2016-01-06 21:00:00+00:00 | 2016-01 | 2016-01-06 14:31:00+00:00 | -20.11 | 9999979.88 | [{\'amount\': 20, \'cost_basis\': 101.706000000000... | -2.011000e-06 | -9.171989 | 0 | 0 | 0 | -9.169708 | 9998972.89 | 1027.1 | 1027.1 | 3 | [{\'dt\': 2016-01-06 21:00:00+00:00, \'order_id\':... | 0.0 |

| 2016-01-07 21:00:00+00:00 | 96.45 | 6.394658e-05 | -1.051300e-05 | 2.633450e-04 | -0.048168 | 0.167868 | 3.005102e-04 | -964.51 | 9997001.37 | 2893.5 | 2893.5 | 0.0 | 0.000289 | 2893.5 | 2893.5 | 1 | -1.051300e-05 | 0.0 | 0.000289 | [{\'created\': 2016-01-06 21:00:00+00:00, \'reaso... | 2016-01-07 21:00:00+00:00 | 2016-01 | 2016-01-07 14:31:00+00:00 | -85.01 | 9999894.87 | [{\'amount\': 30, \'cost_basis\': 99.9543333333335... | -8.501017e-06 | -10.357397 | 0 | 0 | 0 | -9.552189 | 9997965.88 | 2014.0 | 2014.0 | 4 | [{\'dt\': 2016-01-07 21:00:00+00:00, \'order_id\':... | 0.0 |

| 2016-01-08 21:00:00+00:00 | 96.96 | 6.275294e-05 | -8.984000e-06 | 4.879306e-04 | -0.058601 | 0.145654 | 3.118401e-04 | -969.61 | 9996031.76 | 3878.4 | 3878.4 | 0.0 | 0.000388 | 3878.4 | 3878.4 | 1 | -1.051300e-05 | 0.0 | 0.000388 | [{\'created\': 2016-01-07 21:00:00+00:00, \'reaso... | 2016-01-08 21:00:00+00:00 | 2016-01 | 2016-01-08 14:31:00+00:00 | 15.29 | 9999910.16 | [{\'amount\': 40, \'cost_basis\': 99.2060000000002... | 1.529016e-06 | -7.215497 | 0 | 0 | 0 | -7.301134 | 9997001.37 | 2893.5 | 2893.5 | 5 | [{\'dt\': 2016-01-08 21:00:00+00:00, \'order_id\':... | 0.0 |

Access to Previous Prices Using history¶

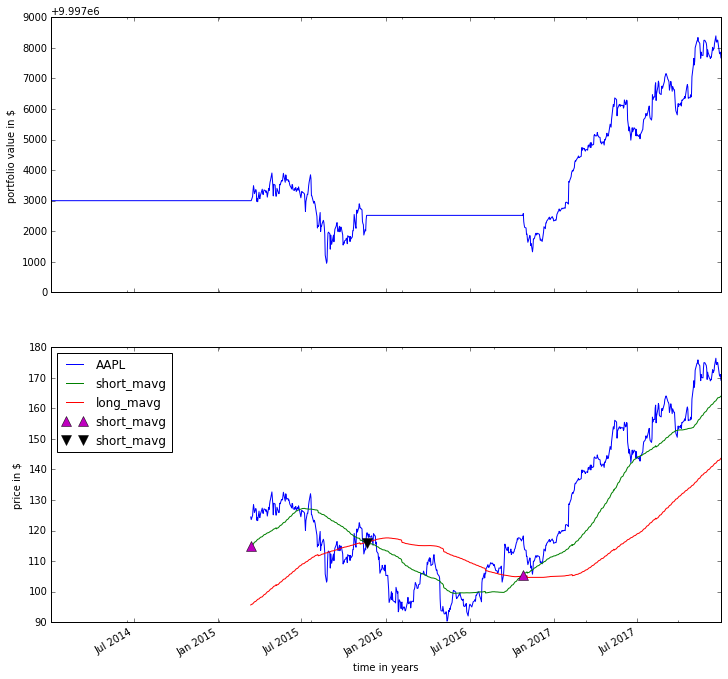

Working example: Dual Moving Average Cross-Over¶

The Dual Moving Average (DMA) is a classic momentum strategy. It’s probably not used by any serious trader anymore but is still very instructive. The basic idea is that we compute two rolling or moving averages (mavg) – one with a longer window that is supposed to capture long-term trends and one shorter window that is supposed to capture short-term trends. Once the short-mavg crosses the long-mavg from below we assume that the stock price has upwards momentum and long the stock. If the short-mavg crosses from above we exit the positions as we assume the stock to go down further.

As we need to have access to previous prices to implement this strategy we need a new concept: History

data.history() is a convenience function that keeps a rolling window of

data for you. The first argument is the number of bars you want to

collect, the second argument is the unit (either '1d' or '1m',

but note that you need to have minute-level data for using 1m). For

a more detailed description of history()’s features, see the

Quantopian docs.

Let’s look at the strategy which should make this clear:

%%zipline --start 2014-1-1 --end 2018-1-1 -o dma.pickle

from zipline.api import order_target, record, symbol

import matplotlib.pyplot as plt

def initialize(context):

context.i = 0

context.asset = symbol('AAPL')

def handle_data(context, data):

# Skip first 300 days to get full windows

context.i += 1

if context.i < 300:

return

# Compute averages

# data.history() has to be called with the same params

# from above and returns a pandas dataframe.

short_mavg = data.history(context.asset, 'price', bar_count=100, frequency="1d").mean()

long_mavg = data.history(context.asset, 'price', bar_count=300, frequency="1d").mean()

# Trading logic

if short_mavg > long_mavg:

# order_target orders as many shares as needed to

# achieve the desired number of shares.

order_target(context.asset, 100)

elif short_mavg < long_mavg:

order_target(context.asset, 0)

# Save values for later inspection

record(AAPL=data.current(context.asset, 'price'),

short_mavg=short_mavg,

long_mavg=long_mavg)

def analyze(context, perf):

fig = plt.figure()

ax1 = fig.add_subplot(211)

perf.portfolio_value.plot(ax=ax1)

ax1.set_ylabel('portfolio value in $')

ax2 = fig.add_subplot(212)

perf['AAPL'].plot(ax=ax2)

perf[['short_mavg', 'long_mavg']].plot(ax=ax2)

perf_trans = perf.ix[[t != [] for t in perf.transactions]]

buys = perf_trans.ix[[t[0]['amount'] > 0 for t in perf_trans.transactions]]

sells = perf_trans.ix[

[t[0]['amount'] < 0 for t in perf_trans.transactions]]

ax2.plot(buys.index, perf.short_mavg.ix[buys.index],

'^', markersize=10, color='m')

ax2.plot(sells.index, perf.short_mavg.ix[sells.index],

'v', markersize=10, color='k')

ax2.set_ylabel('price in $')

plt.legend(loc=0)

plt.show()

Here we are explicitly defining an analyze() function that gets

automatically called once the backtest is done (this is not possible on

Quantopian currently).

Although it might not be directly apparent, the power of history()

(pun intended) can not be under-estimated as most algorithms make use of

prior market developments in one form or another. You could easily

devise a strategy that trains a classifier with

scikit-learn which tries to

predict future market movements based on past prices (note, that most of

the scikit-learn functions require numpy.ndarrays rather than

pandas.DataFrames, so you can simply pass the underlying

ndarray of a DataFrame via .values).

We also used the order_target() function above. This and other

functions like it can make order management and portfolio rebalancing

much easier. See the Quantopian documentation on order

functions for

more details.

Conclusions¶

We hope that this tutorial gave you a little insight into the

architecture, API, and features of zipline. For next steps, check

out some of the

examples.

Feel free to ask questions on our mailing list, report problems on our GitHub issue tracker, get involved, and checkout Quantopian.